Businesses that have borrowed relatively modest sums through the government-backed Coronavirus Business Interruption Loan Scheme (CBILS) could dramatically reduce their interest costs by, switching to the Bounce Back loans facility.

Ministers launched the Bounce Back scheme several weeks into the Covid19 crisis, responding to criticisms that smaller businesses were struggling to access cash through CBILS. By then, however, many businesses had secured finance through the original scheme.

Both schemes are administered through the banks, with the state underwriting the loans. Crucially, however, Bounce Back loans come with an interest rate set by the government at 2.5% a year, while with CBILS, lenders set their own rates; many are charging 6% a year or more! The maximum Bounce Back loan is £50,000, so for businesses that have borrowed less than this from CBILS, it makes sense to switch.

The Bounce Back loan scheme isn’t open to businesses that have already secured finance from CBILS, but there is an exception for firms borrowing in order to pay off a CBILS loan in full. Your bank should be able to help you refinance.

The government has pledged to keep the Bounce Back loan scheme open for applications until 4 November. Both Bounce Back loans and CBILS carry no interest charges or fees in year one, so for businesses confident about repaying CBILS there may be no need to switch.

However, for any business that expects to begin incurring interest, moving scheme makes more sense. On the maximum £50,000 Bounce Back loan, interest charges will cost £1,250 a year from year two onwards. Assuming an interest rate of 6%, the same loan from CBILS will cost £3,000 a year to service

Motivational Quote Of The Day

“You are never too old to set another goal or to dream a new dream.”

C S Lewis

Alternative Quote Of The Day

“Age is something that doesn’t matter, unless you are cheese.”

Luis Bunuel

Shares We’re Buying This Month

While Main Street retail banks contend with shaky consumer confidence and ultra-low interest rates, the trading arms of investment banks help them to profit from loose monetary policy.

Surging corporate debt issuance is good for the underwriting operation and merger activity may pick up later this year. Unpredictable earnings and the Malaysian 1MDB scandal remain problems, but Goldman Sachs Group appears well-placed to profit from the current market environment.

Struggling high streets and empty offices mean that real-estate companies are firmly out of fashion, but that has created some serious bargains to be had. Harworth Group, the land and property regeneration group trades on a reasonable 35% discount to net asset value.

Harworth invests in about 100 residential, industrial and logistics sites across the north of England and the Midlands. That diversification should leave it well-placed however the postpandemic future of work and e-commerce ultimately develops.

Today’s National Day

NATIONAL EMOJI DAY!

PUBLISHERS NOTICE

Dear Streetwise Customer,

I’ve already written to you a couple of times about this cash generating system.

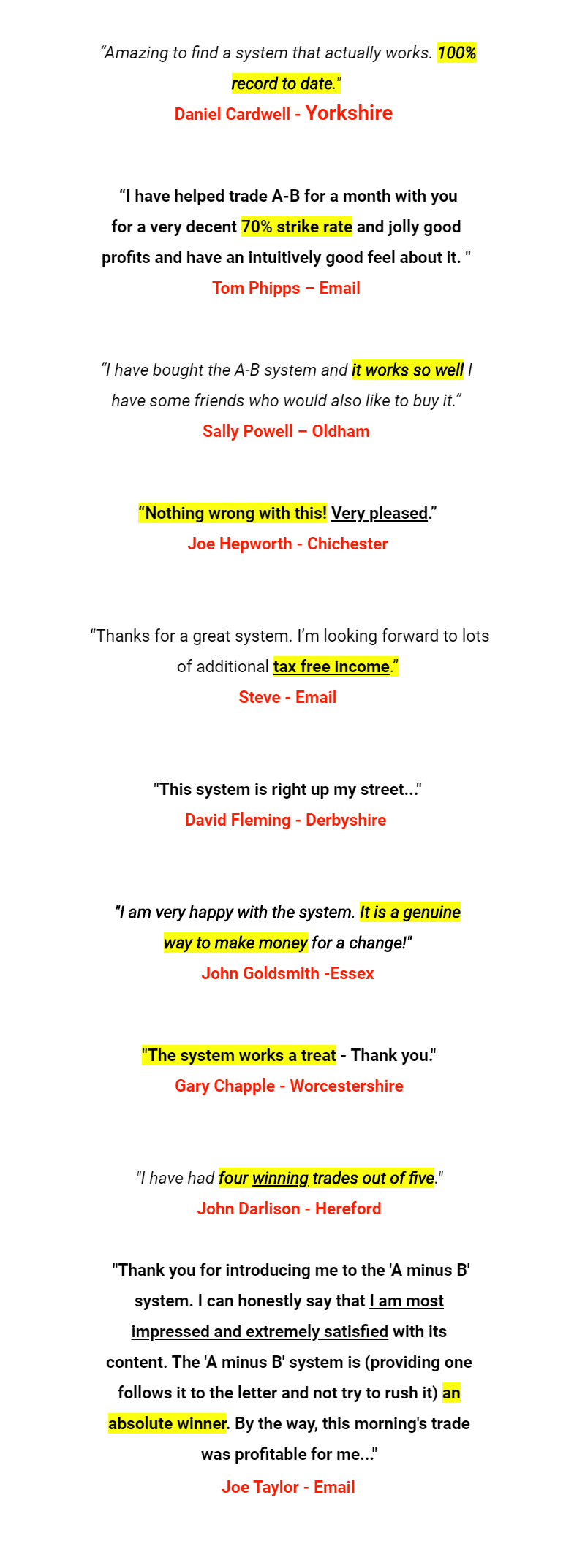

This time though, I’m not going to tell you how good this is. I’m going to let our customers do it instead!

Here are just some of the comments we’ve received recently…

(Incidentally, all of these comments are completely unsolicited and the original copies are held on file at our offices and are available for inspection.)

To get the full story take a couple of minutes to read visit the website below and read the message from David Houghton who figured this out. It reveals this extraordinary opportunity in detail.

Take A Look Now By Visiting:

www.streetwisenews.com/AB

There is absolutely No Risk to you in taking a look at this. The whole

thing comes with a full Cast Iron Money Back Guarantee. All the best for now

John Harrison

Streetwise Publications

PS. Just for good measure here are Mike Pears comments on the A Minus B System:

“O.k. – here are my updates on the A-B System up to my trading week 51. These are all to level stakes.

Week 40 – w/c 16/2 – loss of 16 pts

Week 41 – w/c 23/2 – profit of 37 pts

Week 42 – w/c 2/3 – loss of 2 pts

Week 43 – w/c 9/3 – profit of 80 pts

Week 44 – w/c 16/3 – profit of 37 pts

Week 45 – w/c 23/3 – profit of 75 pts

Week 46 – w/c 30/3 – profit of 38 pts

Week 47 – w/c 6/4 – loss of 51 pts

Week 48 – w/c 13/4 – profit of 62 pts

Week 49 – w/c 20/4 – profit of 30 pts

Week 50 – w/c 27/4 – profit of 144 pts

Week 51 – w/c 4/5 – loss of 45 pts

Total Level stakes profit is 1,821 pts which averages 36.42 per week… A £1,000 starting bankusing 0.1% stakes, now stands at £5,569.”